Let’s start with a basic question: Is your ecommerce store protected from the unexpected?

You may have answered with varying degrees of certainty. After all, no one can predict the future…and you can’t always plan for the unexpected.

The reality, however, is that website setbacks can happen at any moment. You can experience them from human error, malicious attacks, and even buggy apps.

It’s a big problem because, for most ecommerce stores, a single day of downtime can cost the company thousands (or millions) of dollars. This is why protection via ecommerce insurance and backups of your ecommerce platform are so important.

But that doesn’t mean you can’t minimize risk and keep your virtual storefront protected against the worst.

In this post, we’re going to look at several types of ecommerce insurance you can use to keep your business protected from risk as well as how backups of Shopify and BigCommerce can protect your digital data from unexpected setbacks.

Let’s get started.

How ecommerce insurance saved Jeffree Star $2.5M

Murphy’s Law states that “anything that can go wrong, will go wrong.”

No matter how cautiously you run your business, you still can’t protect yourself from the unexpected. Careless mistakes from employees, tech support issues, random acts of nature—they all can bring your company’s productivity to a grinding halt regardless of how careful you are. That’s why businesses need insurance. It protects you from things outside of your control.

“Ecommerce insurance seems is important for an enterprise organization. Let’s say that Amazon went down for a mere 30 seconds. According to data from a 2018 Money.com article, this would result in a $5,730,000 loss if customers didn’t come back to complete the purchases they had planned during the outage. Surely, that potential loss is worth protecting,” said ecommerce expert Maddy Osman.

Now take the case of Jeffree Star, for example.

Just a few short months ago, Jeffree Star, the founder and owner of Jeffree Star Cosmetics had $2.5 million worth of makeup stolen from his warehouse. To make matters worse, a brand new product he was preparing to unveil to the public was also stolen and sold on the black market.

Fortunately for Star, his insurance covered products that were stolen. While we don’t know whether his insurance also covered damages he incurred after his new product was leaked, one thing’s for sure—without insurance, he’d be out of a lot of money.

If Star didn’t have ecommerce insurance to cover his inventory loss, he could’ve lost even more money from:

- Store downtime

- Lags with order fulfilment

- Negative customer experience

As a result, his total loss may have been far greater than just the products stolen from his warehouse.

Of course, this didn’t happen. His insurance company quickly reimbursed him for the stolen items, which enabled him to quickly replace the inventory and get back to business as usual with minimal downtime. It also didn’t stop him from having a massively successful launch to his new product just a couple of weeks after the incident.

If you think that Jeffree’s disaster was a one-in-a-million occurrence…guess again. Setbacks like these can happen to anyone, and if they’re not insured, the fallout can be catastrophic.

As a result, his total loss may have been far greater than just the products stolen from his warehouse.

So how can your business get protection like Jeffree Star had?

Options around ecommerce insurance

There’s a lot to think about when it comes to choosing commercial insurance. If your business is uninsured and you’re still not certain you even need insurance, this piece from Shopify has more information.

As a general rule, it’s a good idea to have some sort of ecommerce insurance in place to prevent a regular mishap from turning into a complete disaster.

Let’s look at the three common types of ecommerce insurance and what they do:

- Liability insurance: Liability protects you from being sued if someone gets injured while using your product, visiting your headquarters, or interacting with your employees. Don’t think just because your product isn’t dangerous that you don’t need liability insurance. Even something like an allergic reaction from a type of soap or lotion could be grounds for a lawsuit.

- Property insurance: Property insurance protects your inventory, equipment and business property. If you’re selling items out of your home and the house burns down, your inventory likely won’t be covered by homeowner’s insurance. You need commercial property insurance for that. This is what protected Jeffree Star from his disaster.

- Transit insurance: If your ecommerce store sells physical items, seriously consider getting transit insurance (also known as inland marine insurance). This keeps your items protected from damage, theft and loss while in transit. If your business requires you to send and receive large batches of inventory to and from warehouses, you definitely want to make sure your cargo is protected once it’s left your warehouse.

With that said, don’t go and purchase ecommerce insurance without first doing your research. Talk to industry professionals, research different companies and policies, and weigh your options. Always ask for advice from fellow retailers and experts before going all in.

Don’t stop at ecommerce insurance: Have backups in place

Most professionals already know the importance of business insurance and why you need it to protect your tangible goods. But what safeguards do you have in place to secure your digital property?

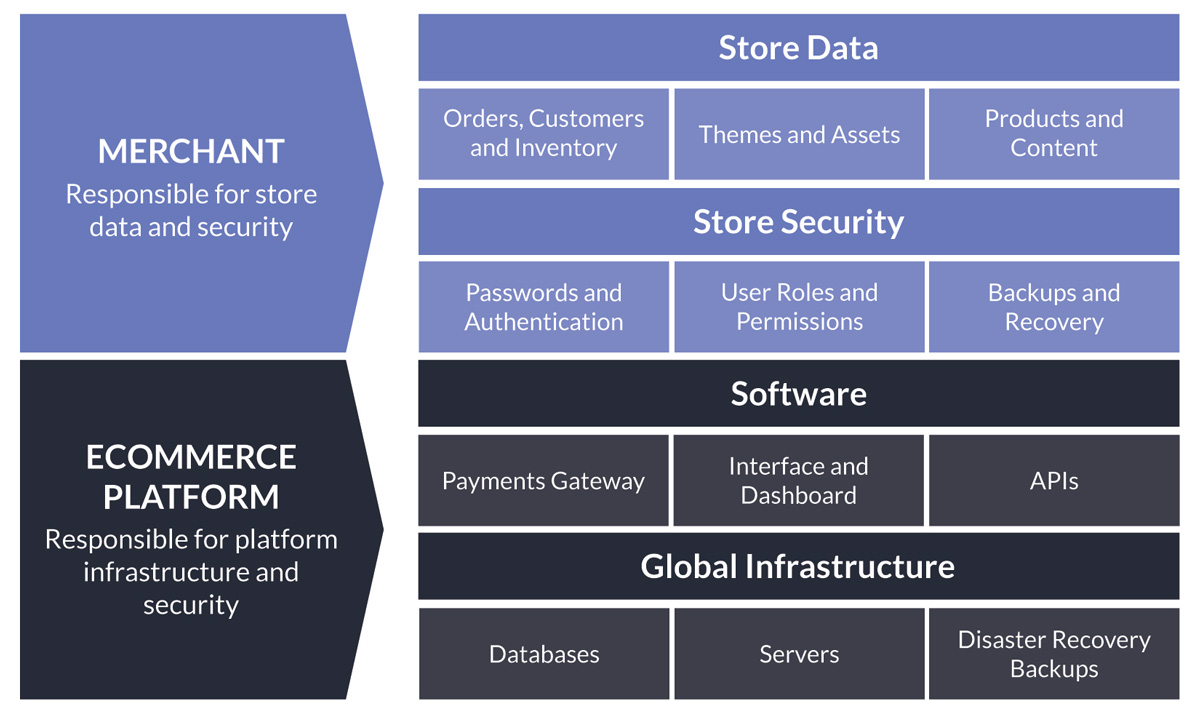

Ecommerce Platforms like Shopify and BigCommerce are only responsible for platform-level backups, meaning that in the event of server downtime, they would be able to recover the entire platform to their last backup. When it comes to data in your individual account – anything from your blog posts and pages to your orders and inventory – the responsibility is on you to have regular and up-to-date backups.

The shared responsibility model:

That means every time you…

- Modify your theme code

- Install a third-party plugin

- Add and delete webpages

…you’re putting your ecommerce site at risk.

And that’s not even getting into damage caused by data breaches, malware or an angry employee trying to sabotage your business—yes, it happens.

Things move quickly in the ecommerce world. When websites go down, brands lose a lot of money. In 2015, fitness and sporting company Gymshark, lost roughly $143,000 in potential sales after an eight-hour outage. And this happened on the worst possible day: Black Friday.

That was in 2015. Imagine if the same thing happened this year. The growing popularity of Black Friday and Cyber Monday means their loss would be even greater in 2019. Of course, they’re not taking that chance again. Gymshark chose Rewind to back up their important business data.

Another example is Knix, a popular clothing company specialising in womenswear. Because they tend to launch products every week, they’re constantly changing and updating the Knix website. One simple mistake could remove product pages or make the whole website inaccessible, costing them thousands in sales. What’s more: this doesn’t even include the money spent in overtime to fix the website or the money lost from delays.

The good news is that this catastrophe can be prevented with a dependable ecommerce backup solution like Rewind. Julia Friesen, the product manager at Knix, shared how Rewind acts as insurance for their ecommerce website:

Be like Jeffree Star: It’s better to be safe than sorry

Rewind safeguards your online store the same way ecommerce insurance protects your inventory and your business. Yes, Shopify and BigCommerce have backups in place in case of platform-wide disasters, but you still need your own backups in case of account-level disasters that could cost you sales and hurt relationships with customers.

In just a few minutes, you can integrate Rewind into either platform and give your business the around-the-clock protection it needs to run smoothly. Join the 25,000+ companies, including GymShark, Paul Mitchell, and MVMT, who never have to stress about the stability of their ecommerce store. Give your Shopify and BigCommerce site the protection it deserves by using Rewind.

If you’re an enterprise brand looking for a scalable backup solution to meet your growing demands, we can help. Contact sales@rewind.com to learn more.